The Maui News

By HARRY EAGAR, Staff Writer

June 15, 2009

WAILUKU – Keaka, Everett Dowling’s development company, was at the Maui Planning Commission last week to seek an amendment to permits for its Maluaka project to drastically downsize the project from 71 luxury condominiums to 13 lots plus recreational facilities. The commission favored it, also praising Dowling for seeking LEED "green" certification on his development.

Demand for luxury housing is down, but it appears that lack of financing is an even greater impediment to developments and redevelopments along Maui’s golden shores.

"We lost our financing," Dowling said of his Maluaka project at Makena, even though half the units had been presold. For a while in February, he shut down the site work while he sought new lenders.

"We took it to 126 lenders and got one term sheet" – the response showing what the lender was prepared to do.

Dowling said he read about that lender, a bank, being in danger of failing, so he declined to pursue a loan. With memories of Maui Land & Pineapple Co.’s narrow brush with disaster at The Residences at Kapalua Bay when lender Lehman Brothers failed, Dowling said a repeat of that trap "was the last thing I wanted."

At least Dowling found a way to proceed. Starwood Capital Group is stymied in its plans to rebuild the Renaissance Wailea Beach Resort. At one time, it was announced as a luxury St. Regis, then later it was to be the first of a string of Baccarat hotels.

Although a special management area permit was obtained, the project never even got to the demolition stage. In January, Starwood Capital (which is separate from the Starwood Hotels & Resorts Group), said it would "take some time" to decide what to do. Inquiries in May about the property were not answered.

At the Royal Lahaina Resort, the next phase of that pioneer Maui resort’s remaking into a luxury destination is on hold.

Gary Hogan, president of owner Hawaii Hotels & Resorts, said a pause "is a pretty good place to be right now."

Although brokers who were to sell the luxury condominiums at the rebuilt resort advised against it, family-owned Hawaii Hotels & Resorts decided to rebuild the Kaanapali resort in phases. Part of the motivation was to avoid laying off workers, some of whom had been there almost since the beginning in the 1960s.

Another reason for delay was just caution. The 12-story tower was extensively rebuilt, and other modernizations were made at the core of the resort, but the rambling cottages were left alone. Brokers advised tearing everything down, in order to "show seriousness."

"That would have been disastrous," said Hogan. Instead of being caught with a bare lot and huge construction and financing bills, Royal Lahaina enters the summer as a functioning hotel and is even booked to show a surprising 86 percent occupancy rate this month.

Overall, Maui resorts hit record low occupancies in April, but Hogan said Japanese and some European business is buoying his resort.

The model condominium that was built on the shore is still open, and Hawaii Hotels & Resorts is still marketing itself for the resumption of its rebuilding when financial conditions improve.

The company’s two resorts – Royal Lahaina and Royal Kona – "definitely got hit," Hogan said, and he told his employees, "It was my fault."

He expected a rebound following the elections, and when that didn’t happen, the properties went through a "rough five months."

Revenue still "isn’t what it was," due to price-cutting, and swine flu worries in Japan have recently undone some of the gains he was starting to see earlier; but Hogan said he is prepared to wait until conditions improve.

"We are not very leveraged," he said, and while national and international lenders are still shy, Royal Lahaina was able recently to complete a refinancing with a local bank, which Hogan didn’t name.

"We were very attractive to local banks that understand Hawaii and the value of real estate," he said.

The situation at Kapalua is more obscure. After tense months, ML&P was able to negotiate new financing with Lehman Brothers’ estate in bankruptcy to complete the Residences, which were far along. Those properties were opened this month, and sales are continuing on that $355 million project.

However, Lehman also holds a $260 million note on the Ritz-Carlton, Kapalua hotel. ML&P’s first-quarter filing with the Securities and Exchange Commission says that loan was in default in April because two monthly payments had not been made.

The hotel is owned by W2005 Kapalua/Gengate Hotel Holdings LLC, whose managing general partner, Gencom, did not respond to questions. The filing said the joint venture is "working on options to restructure the loan with Lehman."

ML&P has a 15.9 percent share in the venture but is not responsible for repaying the loan.

Apparently financing for the rebuilding of the hotel, which was shut down for most of 2007, was difficult, because the partners were asked for cash contributions. ML&P, having its own operating problems, chose not to participate, so that its original 21.4 percent interest in the equity of the property was reduced to 15.9 percent.

Another project, although not in a resort area, where a developer is seeking to renegotiate financing is Kula 1800.

The lender has started a foreclosure action for this stalled agricultural subdivision on Naalae Road. The amount is $18 million, because the development didn’t get much further than drilling wells.

Developer Charlie Jencks said the foreclosure notice is routine, and he expects to find arrangements to keep the project alive until things revive enough that Kula 1800 Investment Partners can seek construction financing.

"We will probably be able to keep it viable for two more years," he said. "No one is buying anything now," so no one is anxious to be lending, either.

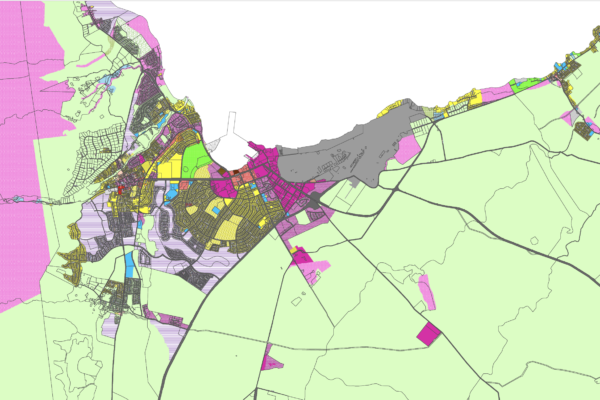

Jencks was involved in Wailea 670/Honua’ula in the late ’80s, left for other jobs, including county public works director, and came back to shepherd that project to rezoning after a gestation period of 20 years. He said the ups and downs of the real estate environment were nothing special.

Dowling said he does have buyers: The people who were ready to buy his condos are willing to buy lots and build themselves. He quickly sold 40 percent of the lots, primarily to people who had intended to buy the penthouses if the condominium project had gone forward.

For the buyers, finding financing wasn’t an issue. Most were ready to pay cash.

Unlike ML&P, Dowling did not have hundreds of millions of dollars worth of uncompleted buildings held hostage when his lender backed down. But like ML&P, he was close enough to having something to sell that he was able to manage financing.

At Maluaka, the site work bill was about $20 million, and Dowling had paid about 80 percent of that when his lender left.

So he needed to find only about $4 million to complete ground work, and another $13 million for the recreation center that was part of the original plan.

With two units atop that building, that gave him 15 products to sell for a comparatively small additional investment, compared with the original capital-hungry proposal.

Dowling said he is persuaded that the luxury real estate market will revive on Maui, and in fact will lead the way to economic recovery. "This too shall pass. The high-end will pull us out of it," he said.